Girish's Real Estate Market Observer - Dec '23 Edition

The graphs represent various aspects of the single-family home (SFR) market in Contra Costa and Alameda Counties over several months. To provide a precise analysis of the market for laypersons, I will break down each graph and its implications for buyers, sellers, and investors.

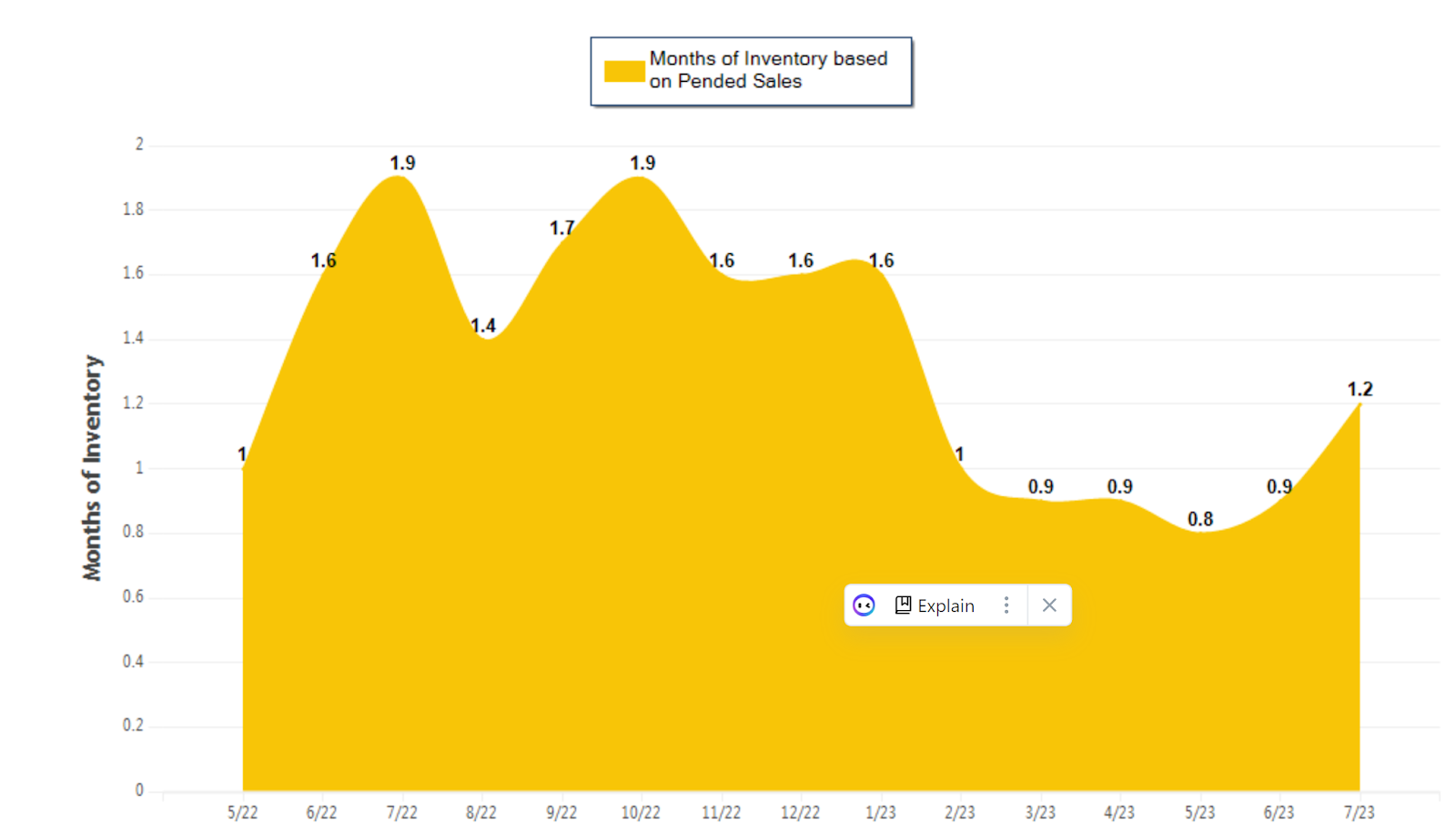

Months of Inventory Based on Pended Sales:

- This graph shows the fluctuation in the months it would take to sell all the houses currently on the market based on the current rate at which homes are going under contract (pending sales).

- A lower number indicates a seller's market, where demand and inventory are expected, potentially leading to higher prices. Conversely, a higher number suggests a buyer's market, with more inventory and less competition among buyers.

- For Buyers: When the months of inventory are low (around 3/23 with 0.8 months), it implies a competitive market, and they may need to act quickly and bid above the asking price. As the months of inventory increase (as seen towards 11/23), buyers might find more options and less competition, potentially leading to better deals.

- For Sellers: The period with lower inventory (around 3/23) might be an ideal time to sell, as they could get higher offers. As inventory increases (towards 11/23), sellers may face more competition and must be more flexible with pricing or terms.

- For Investors: Low inventory periods can mean a quick appreciation of property values, suitable for short-term investment. An increasing trend in inventory may indicate a cooling market, which could be advantageous for investors looking to purchase rental properties at lower prices.

Median Price Graph (Sold vs. For Sale):

- This line graph contrasts the median prices of homes sold with those currently for sale.

- The sold prices are a lagging indicator reflecting past market activity, while the for-sale prices can be seen as a leading indicator of where the market might be heading.

- For Buyers: When the sold prices are lower than the for-sale prices (like between 3/23 and 5/23), it suggests that buyers may need to negotiate harder or wait for a market correction. However, if sold prices approach or exceed for-sale prices (as seen around 9/23), it could indicate a market peak.

- For Sellers: Ideally, sellers want to list their homes when the for-sale prices are at a premium compared to recently sold prices, indicating they could sell their homes for more.

- For Investors: Tracking the gap between sold and for-sale prices can help investors gauge the market's momentum and time their entry and exit for maximum gain.

Number of Homes (For Sale, Sold, Pended):

- This bar graph shows the number of homes for sale versus those that have been sold or are pending sale each month.

- The red line indicates the trend in pended sales, a measure of demand.

- For Buyers: An increasing number of homes for sale, combined with a steady or decreasing number of pended sales (seen after 5/23), could signal a cooling market where buyers have more leverage.

- For Sellers: A decrease in pended sales relative to the number of homes for sale suggests that sellers might need to be more competitive with pricing or terms.

- For Investors: A decreasing trend in pended sales may hint at a slowing market, which could affect the potential for quick resales but may increase rental demand as potential buyers wait out the market.

Current and Future Implications:

- Now: The data suggests that as of the latest data point (around 11/23), there is an increase in inventory, indicating a possible shift towards a buyer's market. This can mean more negotiating power for buyers, while sellers may need to adjust expectations.

- Future: If increasing inventory and decreasing pended sales continue, it could lead to a more pronounced shift towards a buyer's market. This would affect pricing strategies for sellers and offer investment opportunities for buyers looking to enter the market.

Understanding these trends can help all parties make informed decisions. Buyers can gauge the competition and pricing environment, sellers can strategically time the market for listing their homes, and investors can assess the potential for property appreciation or rental demand.