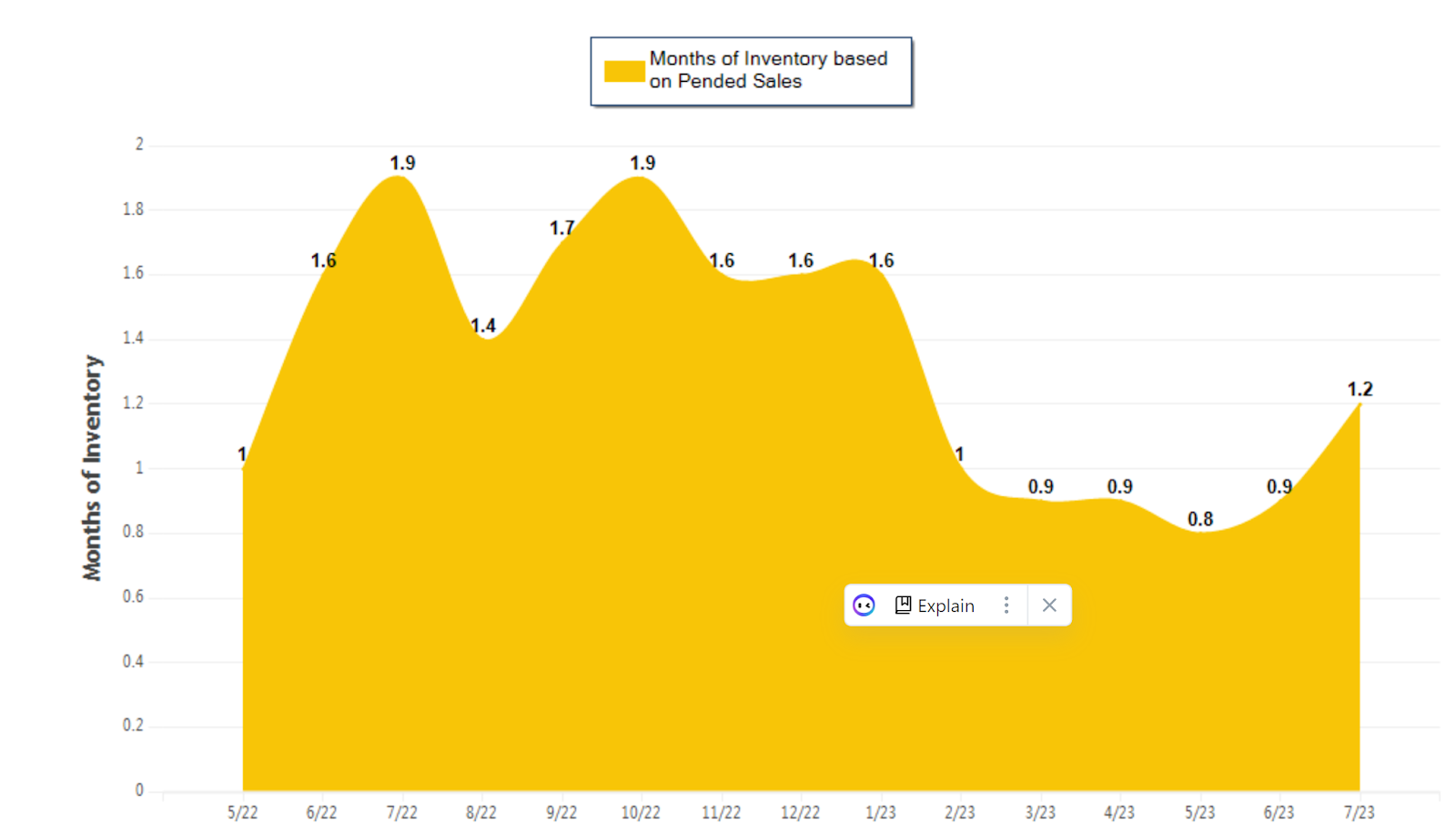

In the July ‘23 update, we delved into the shifting landscape of median sale prices and their interaction with interest rates for single-family homes in Contra Costa and Alameda counties combined. Despite a decline in the median sale price, the impact of rising interest rates has caused monthly payments to remain elevated. This month, our focus turns to the influence of inventory levels on buyer demand within these two counties. (Please don't hesitate to reach out if you require data for other Bay Area counties or cities – I'm here to assist.) Let's dive into the details, including figures and the accompanying graph.

- This marks a 33.1% increase when compared to the previous

month.

- However, juxtaposed against last year's same month, it

demonstrates a notable 37.6% decrease.

July 2023 experienced a surge in inventory compared to June 2023, offering buyers a slight respite. It's worth noting that July of this year witnessed an extraordinary 37.6% decline in inventory compared to July of the prior year. The conventional wisdom suggests that an escalation in interest rates should naturally dampen demand (a strategy that the Federal Reserve employs to influence the broader economy). However, the existing dearth of supply continues to fuel a heated market, ensuring buyers still grapple with multiple offers and competitive bidding wars. While the extended period of the Bay Area housing bull market since 2012 has seen intermittent lulls, the pent-up demand consistently regains momentum. This phenomenon was observed between July and December of the previous year when potential buyers hesitated on the sidelines following three consecutive interest rate hikes. Notably, most of these buyers resurfaced in January of the current year, overcoming their initial apprehensions and adjusting to the revised rates.

For a broader context, please examine the inventory levels dating back to 2018, a pivotal juncture at the outset of the housing bubble burst.

- A buyer's market entails more than 6 months of inventory,

based on pended sales.

- Conversely, a seller's market is characterized by less

than 3 months of inventory, per pended sales data.

Based on pended sales, a balanced or neutral market

corresponds to a range of 3 to 6 months of inventory.

Remember that these parameters can exhibit variability

across distinct geographical areas.

For any further inquiries or insights, do not hesitate to

contact me. I remain at your disposal.