Girish’s Real Estate Market Observer

Who will bail out the buyers?

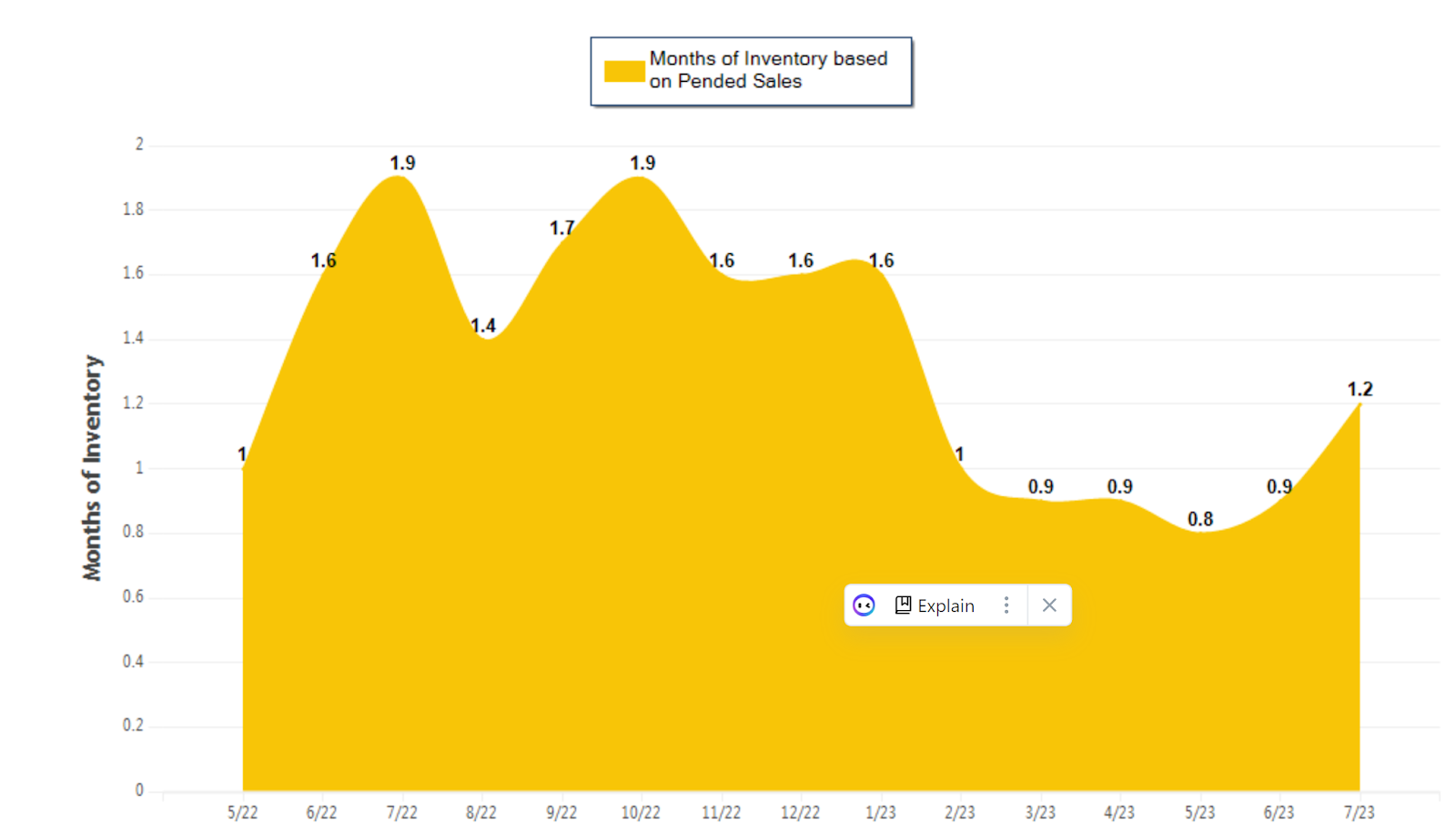

Challenging is not the word to describe the home buyer’s world in the Bay Area. It’s brutal and has been so for many years. The inventory of homes (combined Alameda and Contra Costa County) continues to be anemic (sellers being locked into low-interest rates and seasonal factors). At the same time, the inventory has picked up month-over-month since February 2023 (Fig 1); it’s not enough compared to the demand. The net result is no different from the last few months, and prices remain steady, dipping ever so slightly (Fig 2). Of course, many neighborhoods are attracting multiple offers and bidding wars. It shows that the Bay Area buyers are willing and capable of shelling out money from their deep pockets. Higher interest rates are now a distant memory. Talking about it, the market is more sensitive to changes in interest rates rather than absolute numbers. So, watch the interest rates (Fig 3) as you move forward. The buyers are expected to return to the market after the holidays, and if the inventory of homes stays where it is, next year will be more competitive and less forgiving for the buyers.

So, let’s get back to the question: who will

bail out the buyers?

1. Supply is not going to improve overnight

(the sellers are sitting tight, and the cities are not doing much to help build

new homes)

2. Higher or lower interest rates are not the

solution, especially when the supply is low. There are enough buyers no matter

what the interest rates are

3. Economic shock and related turmoil in the

job market - loss of jobs and an eventual inventory glut. Sorrow for many and

opportunity for some. Will that happen? My answer is as good as yours.

Contact me if you need in-depth real estate market analysis for your city.

Figure 1: Combined For Sale and Sold SFRs, Contra Costa, and Alameda County.

Figure 2: Median Sale Price of SFR in Alameda and Contra

Costa County.

Figure 3: Average 30-Year Fixed Mortgage Rates.